Posted on 2014-Jan-02

What Lies Ahead

It is that time of the year when people are anticipating what better things await them in 2014. Predicting what will be trending, several blogs analyze the data as collected this year and opinionate what will happen to the eBook and eReading scene in the next few weeks.

Bold Prediction about eBooks and Digital Publication

Starting with Digital Book World that makes 10 bold predictions about eBooks and digital publication, we only select the prediction that fits this blog content. 1) It has been an unfortunate year for Nook to experience several difficulties in their business operation. Having lost money together with the sales of its content and devices, this year’s revenue ($109 million) could not replicate the success around the same period they had ($160 million) last year. 2) However, the brick and mortar shop remains an attractive option for Amazon to go down the same road. According to Brad Stone, “Bezos and colleagues have always said they’ve considered physical locations.” The physical shop will serve as a showroom for Amazon products (e.g. their signature eReaders, best-seller eBooks, along with other wow factors that will impress offline customers. 3) Several predictions about traditional publishers signifies their expansion beyond relying solely on best-sellers. 4) Publishers will probably develop new business models (e.g. conferences and education),since the sales of their eBooks start to decline. 5) eBook subscription model seems to be another model for traditional publishers to republish backlists and earn something out of it. Regardless of the slow adoption, Oyster, Entitle (formerly known as eReahtah), and Scribd will started offering affordable monthly fee late in 2013. Andrew Rhomberg, founder of Jellybooks, said that the eBook subscription model is a ‘strategic response’ to Amazon. 6) eBook Price reductions will continue to be the trend as the data shows how eBook’s best-sellers prices have decreased.

Indie Authors Counterclaim

In response to one of the predictions on The Digital Reader website, indie author Marc Cabot saw the problem in the slow eBook sales of which no publishing parties have ever revealed their actual source of income. Without the statistical data to back up, the bold prediction is incomplete in itself. Hugh Howey further disapproves any reference to eBook sales citing Bower’s ISBN issuance and information provided by publisher. Considering publicly available information that 25% of best-seller titles are written by self-publishers, Nate of The Digital Reader comments on the eBook subscription model is nothing new since several publishers have already signed the deals.

Predictions about eReading Hardware

GoodEReader also comes up with its own list of predictions but not from the industry perspective, it focuses on the hardware perspective. To reinstate Barnes and Noble’s bad news, despite investing a large sum of money to develop content for their Nook devices and the technology for their eReaders, actual sales are not the strong indicator of their return on investment. Moving away from hardware development, B&N will focus more on creating content especially with the help from Microsoft. This year also sees the steady decline of tablet sales as opposed to smartphones. There is a possibility that smartphone sales will outperform tablets by fourfold (242.72 million smartphone touch panels vs. 51.81 million). The myth of slow eBook sales will remain to be investigated according to The Association of American Publishers that collected data from about 1,200 publishers. Len Vlahos, the executive director of the Book Industry Study Group, said in an interview “But all the data we see suggests that we’ve hit a state of equilibrium. The trend lines have flattened out. Three years ago, it was a nascent market, but now it looks like a maturing market.” Not only B&N has gone through a tough year, Sony is nearly a no-show in eReader market with the disappointing sale of its supposedly flagship model PRS-T3 and the 13.3 digital slate.

Although it has remained open to interpretation how the association gets their fact straight, questions on The Digital Reader begs to differ. Given the traditional publisher’s data, several people question how indie authors’ sales on several channels (i.e. Amazon, Smashwords) are left out from the report. David Gaughran thinks that there is a lot of revenue being excluded from the measurement.

150 KDP Authors Sold 100K+ Copies

Although the last data is not actually a prediction, the press release from Amazon regarding KDP causes a minor stir across indie authors to discuss their challenges in marketing their book. Having advertised a bunch of its programs, numbers never stop short of being inserted to add credibility in Amazon’s press release. While those figures might sound exciting, indie authors do not uniformly agree. The uplifting revelation that “150 KDP authors each sold more than 100,000 copies of their books in 2013” invites the commenters to speculate how the actual income could be financially translated in accordance with different book prices. Although the income p.a. may not be eye-popping for a commenter who saw ten-times higher income years ago, selling 100K copies of an book priced at $2.99 is translated to $200K under the KDP condition. This is just one source of revenue stream excluding other major vendors in the market.

Patrice Fitzgerald and Paul Draker try to provide the optimistic tone of the story to indicate that “selling in high numbers” can happen. Citing Joe Konrath’s sky-high sales early this year strictly on Kindle, Paul’s reaffirmation of how sales from other vendors could make higher numbers on top of what’s reported. He also makes reference to Hugh Howey’s statement that the vast majority of midlist authors should be paid more attention to since they start to make a living from their writing and their income is worth a close observation.

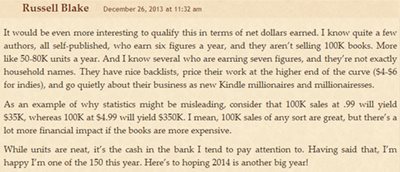

In addition to figures and numbers calculation, Russell Blake shares his insights about the greater success of what fellow self-publishers have achieved. Although they merely sell between 50-80K p.a., their income reaches six figures and some even step over the seven-figure threshold. Their pricing strategy is a collection of backlists and setting price way above the curve ($4-$6). To look at the number titles sold alone can be inadequate to judge the authors’ income depending on the book prices authors set. Apparently, pricing above the curve is one way to boost the cash flow in the bank, and this is the real money that can make a big difference in one’s life.

Food for Thought

We do hope 2013 has been a great year for your book launches and sales. If this year is not what you have expected, the lists of predictions mentioned above can serve as a rough guidance for you to anticipate 2014 with better preparation and comprehension. Perhaps, it is obvious that the eBook industry’s growth is pretty dynamic beyond the single analysis to make “bold” predictions when the industry itself is fragmented. Nevertheless, despite of uncontrollable external factors (e.g. hardware production, statistical presentation, data interpretation), what Russell Blake points out is worth pondering. To be a financially successful indie author, one should be aware of the value in higher price point that can generate revenue to sustain their career. If your position is not well-placed among the best sellers, Hugh Howey’s point should remain intact that mid-list authors can make enough for their living from their writing. Through self-publishing, authors have the freedom to directly cater to the need of their readers without being restrained by the waiting game. Focusing their energy to produce the top quality piece of writing and knowing how to monetize their backlist titles will always remain the survival kit come what may come.

Label: eBook Industry News

comments powered by Disqus